The Household Paper Industry in China: A BillionDollar Category Moving Towards Sustainability and Functionality

According to the “Research on the Current Development and Investment Prospects of China’s Household Paper Industry (2024-2031)” report by Guanyan Report Network, household paper refers to a variety of hygiene papers used for personal care both at home and while traveling. These include toilet paper rolls, facial tissues, boxed tissues, pocket tissues, handkerchiefs, napkins tissue, kitchen towels, wet wipes, shoe polishing paper, and hand towels, covering various aspects of daily life.

The production of household paper involves three main stages: pulping, raw paper production, and postprocessing. Raw materials like wood, bamboo, straw, and bagasse are transformed into finished products through these processes. Pulping refers to the physical and chemical conversion of raw materials into pulp, which is further processed into paper using papermaking machines. Post processing involves cutting, rewinding, embossing and packaging to create the final product.

I. Industry Development Status

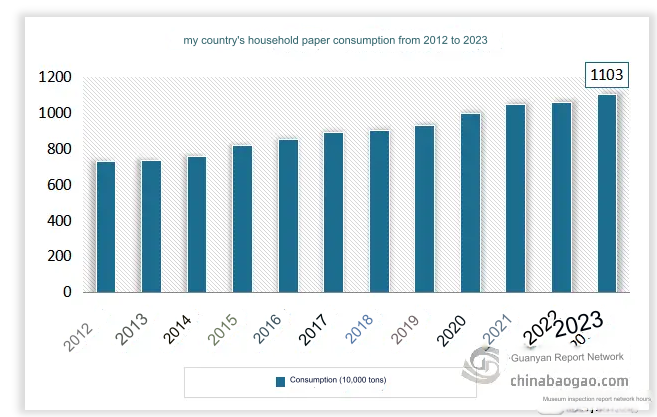

Household paper is an essential fastmoving consumer good (FMCG). In recent years, with China’s rapid economic growth, improved living standards, and evolving consumption habits, the demand for household paper has grown steadily. Data shows that by 2022, the per capita consumption of household paper in China reached 8.4 kg, a 2.4% increase yearoveryear.

The market for household paper has expanded continuously due to rising demand, becoming a billiondollar industry. It now features product segmentation, functional innovation, and specialized applications. Between 2012 and 2023, the market size increased from 76.57 billion RMB to approximately 154.9 billion RMB.

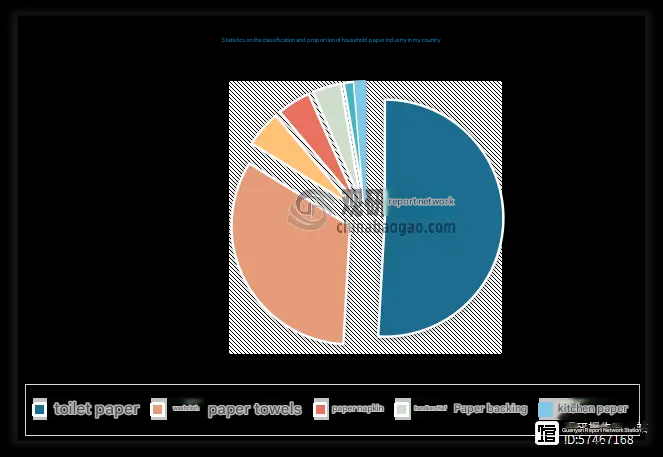

Market Share by Product:

- Toilet paper: 51.03%

- Facial tissues: 32.6%

- Hand towels, handkerchiefs, and napkins: 5.24%, 4.59%, and 3.85%, respectively.

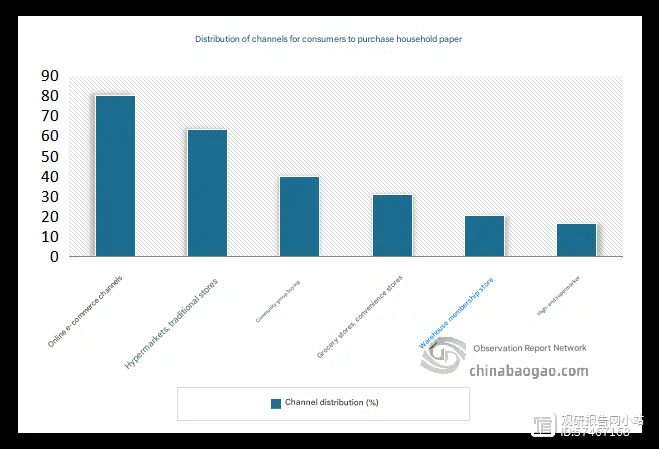

Distribution Channels:

Ecommerce has become the dominant platform, providing better discounts, broader product selection, and convenience. As a result, online sales have grown rapidly, overtaking traditional retail channels.

II. Supply and Demand Scale

1. Supply Situation:

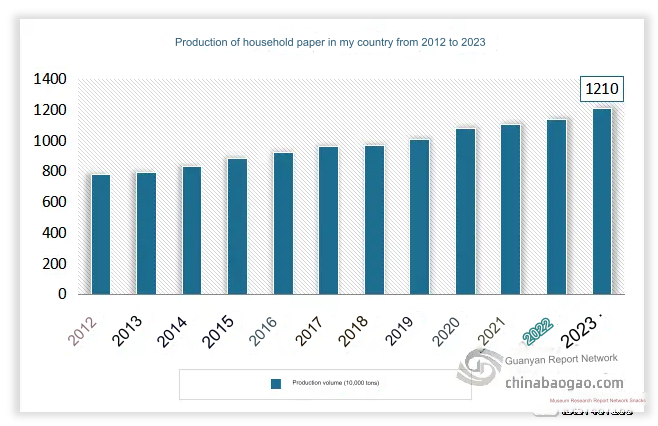

The industry has witnessed significant growth, with total production capacity reaching 20.37 million tons in 2023, a 6.4% increase yearoveryear. During the same year, 37 companies introduced 69 new paper machines, adding a production capacity of 1.771 million tons.

In the first quarter of 2024, newly commissioned capacity was 428,000 tons per year across 19 machines, with most investments coming from major companies like Hengan and Lee & Man.

| Project Province | Capacity/(10,000 t/a) | Number of paper machines | Number of paper mills in operation |

| Guangxi | 45.8 | 22 | 11 |

| Fujian | 24 | 4 | 1 |

| Shandong | 22.9 | 8 | 6 |

| Sichuan | 15 | 7 | 3 |

| Jiangxi | 14 | 6 | 2 |

| Hubei | 9.5 | 3 | 2 |

| Liaoning | 9 | 3 | 1 |

| Anhui | 8 | 4 | 1 |

| Hunan | 6.5 | 2 | 1 |

| Guangdong | 5 | 2 | 2 |

| Hebei | 4.5 | 2 | 2 |

| Yunnan | 4 | 2 | 2 |

| Shanghai | 3.6 | 2 | 1 |

| Zhejiang | 3.5 | 1 | 1 |

| Xinjiang | 1.8 | 1 | 1 |

| total | 177.1 | 69 | 37 |

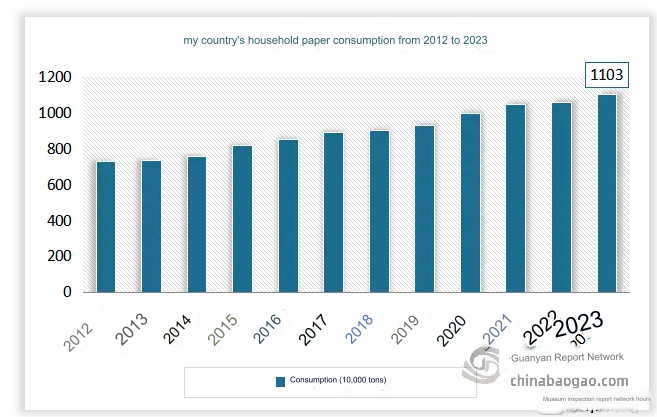

2. Demand and Consumption:

China remains the largest consumer of household paper worldwide, with consumption reaching 11.03 million tons in 2023, a 4.1% increase from the previous year.

Exports:

In 2022, China exported 785,700 tons of household paper, representing 6.24% of total production, with an export value of $2.034 billion. The first three quarters of 2023 saw further growth, with exports reaching 804,200 tons and generating $1.762 billion in revenue.

III. Competitive Landscape

The market has become increasingly concentrated, with the number of paper producers falling from 213 in 2022 to 208 in 2023. Major players such as Gold Hongye, Hengan, Vinda, and Zhongshun remain dominant, with a combined capacity of 6.15 million tons, or 30% of the market. However, the domestic market remains less consolidated compared to international markets, where the top three players control over 80% of the market.

The rise of six emerging companies focusing on raw paper and large rolls has also intensified competition. New entrants like Lee & Man, APP, and Sun Paper are gaining traction, increasing competition across the value chain.

IV. Industry Trends

1. Room for Growth in Per Capita Consumption:

While per capita consumption reached 8.4 kg in 2022, it still lags behind the U.S. (29 kg) and Japan/Western Europe (1617 kg). With ongoing economic development and improvements in living standards, consumption is expected to grow further.

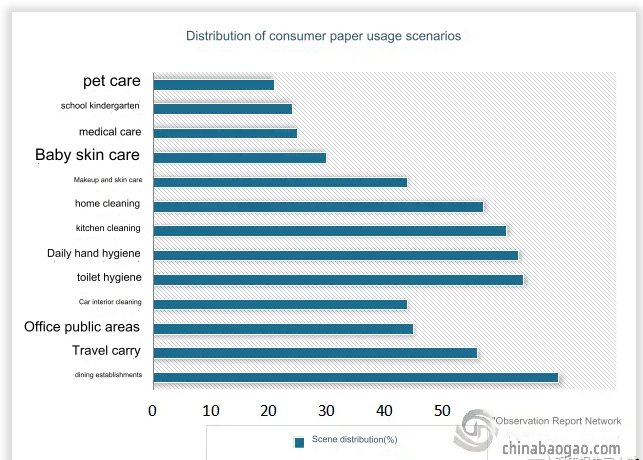

2. Diversification of Usage Scenarios:

Consumer preferences are diversifying, with household paper now being used across multiple environments, including homes, offices, and restaurants. Survey data indicates that consumers typically use paper in five or more scenarios.

3. Product Upgrades Driven by Consumption Trends:

As disposable income increases, consumers are willing to invest in premium paper products. While toilet paper still holds a 51% market share, categories like facial tissues, hand towels, and kitchen paper are growing. Consumers are also showing a preference for specific paper types based on their intended use.

4. Environmental Policies Favor Market Leaders:

Strict environmental regulations are pushing smaller, less efficient manufacturers out of the market, leading to further consolidation. Larger companies benefit from modern production capabilities, better environmental compliance, and stronger market positioning.

V. Development Trends: Green, Functional, and Differentiated Products

1. Green and Healthy Products:

Consumers are increasingly concerned with environmental impact and product safety. Companies are adopting ecofriendly materials such as unbleached wood pulp and bamboo. Many brands now focus on reducing chemical additives and incorporating antibacterial properties in their products.

2. Differentiated Products:

To meet diverse consumer needs, manufacturers are introducing unique features such as enhanced softness, fashionforward designs, and targeted packaging. Differentiation extends to postprocessing techniques that enhance customer loyalty and brand appeal.

3. Functional Innovations:

Products with added functionalities are gaining popularity, such as embossed paper with superior water absorption and antibacterial tissues. Innovations include flushable toilet paper and moisturizing facial tissues, meeting evolving consumer demands.

4. Diverse Product Offerings:

With rising consumer expectations, companies are expanding their product portfolios beyond basic offerings to include cotton tissues and hand towels, which have grown at a 20% annual rate. Leading brands are also segmenting their product lines across various price points.

The Chinese household paper industry is moving towards highend, functional, and ecofriendly products, driven by technological advancements and changing consumer preferences. Market leaders are wellpositioned to capitalize on these trends through R&D investments and strategic product development, consolidating their competitive edge in the expanding market.