New Production Capacity Remains at a High Level, Industry Competition Further Intensifies

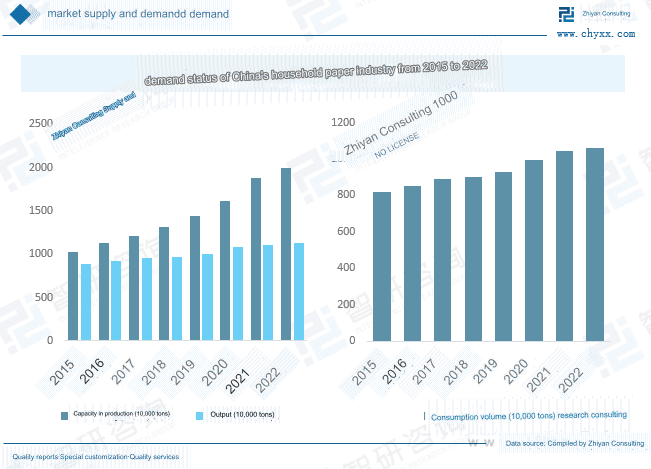

Over the past 30 years, with China’s rapid economic growth, improved living standards, and changing consumer habits, the demand for household paper products has been continuously increasing. In 2022, China’s household paper industry continued to grow, with total industry capacity reaching 20 million tons, the highest level in history. Production reached 11.35 million tons, a year-on-year increase of 2.7%, while consumption reached 10.59 million tons, a year-on-year increase of 1.24%.

I. Overview of the Household Paper Industry

Household paper refers to various types of sanitary wiping paper used for personal care at home and outdoors, including toilet paper rolls, facial tissues, boxed facial tissues, pocket tissues, handkerchiefs, napkins, kitchen paper towels, wet wipes, shoe-cleaning paper, and hand towels. The household paper industry is an important sub-sector of the paper industry. Household paper products are closely related to people’s daily lives, are indispensable items, and belong to the fast-moving consumer goods category. The types of household paper products continue to expand with the development of the times and can be divided into four main categories.

| Main categories of tissue paper | |

| category | describe |

| Toilet paper and its products | This category of products mainly includes ordinary toilet paper, pleated toilet paper, roll toilet paper, pull-out toilet paper, boxed toilet paper, pocket handkerchiefs, napkins and kitchen paper, etc. |

| Disposable hygiene products | The characteristics of this type of product are that it cannot be reused and is thrown away after use. Sanitary products may include sanitary napkins, adult diapers (incontinence products), baby diapers, wetTowels, sanitary napkins, cosmetic cotton, paper masks, tablecloths, etc.. |

| Disposable paper container | Such as paper lunch boxes, paper vases, paper cups and so on. |

| Specialty Paper | This type of product often has a specific purpose, Special usage scenarios, such as laminate flooringWear-resistant paper, dust filter paper, vacuum cleaner bag paper, lampCover paper, fly paper, paper furniture, etc. |

II. Relevant Policies for China’s Household Paper Industry

The release of relevant industrial policies has standardized the development of the household paper industry, contributing to the transformation of the paper industry’s growth model, resource conservation, and pollution reduction. Currently, the main policies for China’s household paper industry are as follows:

| A review of relevant policies in China’s household paper industry | |||

| date | Publishing Agency | Policy Name | main content |

| Jun-2022 | Ministry of Industry and Information Technology and other five departments | “Guiding Opinions on Promoting the High-Quality Development of Light Industry” | Aiming at the weak links in the papermaking, household appliances, daily chemicals and other industries, we will study, formulate and publish a number of technical innovation roadmaps in key areas, implement measures such as “unveiling the list and appointing the leader”, deepen the technological research and development, engineering and industrialization, accelerate the establishment of a core technology system, and improve the technical level of the industry. Facing major future consumer needs, we will promote the establishment of cross-industry and cross-disciplinary exchange mechanisms and strengthen the layout of strategic frontier technologies. |

| Jan-2021 | The Development and Reform Commission and other departments | “14th Five-Year Plan” National Clean Production Promotion Plan | The Beijing-Tianjin-Hebei region and its surrounding areas, the Fenwei Plain, the Yangtze River Delta, the Pearl River Delta, the Chengdu-Chongqing region and other regions will focus on implementing clean production transformation in packaging and printing, and promote coordinated control of fine particulate matter (PM2.5) and ozone (03). The Yangtze River and Yellow River basins will focus on implementing clean production transformation in the papermaking, printing and dyeing industries to reduce emissions of ammonia nitrogen and phosphorus pollutants. |

| Mar-2021 | NDRC and other 13 departments | Opinions on Accelerating the High-Quality Development of the Manufacturing Service Industry | Carry out the construction of green industry demonstration bases, build a green development promotion platform, cultivate a group of market players with independent intellectual property rights and professional service capabilities, and promote the improvement of green water and sub-water in industries such as papermaking. |

| Mar-2021 | CPC Central Committee | “Outline of the 14th Five-Year Plan for National Economic and Social Development of the People’s Republic of China and the Long-Term Objectives for 2035” | Transform and upgrade traditional industries, promote layout optimization and structural adjustment of raw material industries such as petrochemicals, steel, and building materials, expand the supply of high-quality products such as light industry and textiles, accelerate the transformation and upgrading of key industry enterprises such as chemicals and papermaking, and improve the green manufacturing system. |

| Feb-2021 | State Council | Guiding Opinions on Accelerating the Establishment and Improvement of a Green, Low-Carbon, Circular Development Economic System | Accelerate the implementation of green transformation in industries such as steel, petrochemicals, chemicals, nonferrous metals, building materials, textiles, papermaking, and leather. Promote green product design and build a green manufacturing system. |

| Jan-2021 | National Development and Reform Commission | Guiding Opinions on Promoting the Utilization of Wastewater Resources | Focusing on high water-consuming industries such as thermal power, petrochemicals, steel, nonferrous metals, papermaking, and printing and dyeing, we will organize the utilization of wastewater within enterprises, create a number of industrial wastewater recycling demonstration enterprises and parks, and drive the improvement of enterprise water use efficiency through typical demonstrations. |

III. Household Paper Industry Supply Chain

The paper industry is a capital-intensive and technology-intensive industry with a long supply chain, broad scope, high environmental requirements, and high national attention. The household paper supply chain can be divided from top to bottom into raw materials, pulping, base paper, and finished paper products. Upstream raw materials can be categorized into wood, rice and wheat straw, reeds, bamboo, etc. The midstream pulping and papermaking segment can be divided into wood pulp, non-wood pulp, and recycled paper pulp. Leading companies in the industry generally purchase overseas wood pulp and base paper assets, while small and medium-sized enterprises usually purchase domestic wood pulp or directly buy base paper. Therefore, leading companies have stronger cost control capabilities.

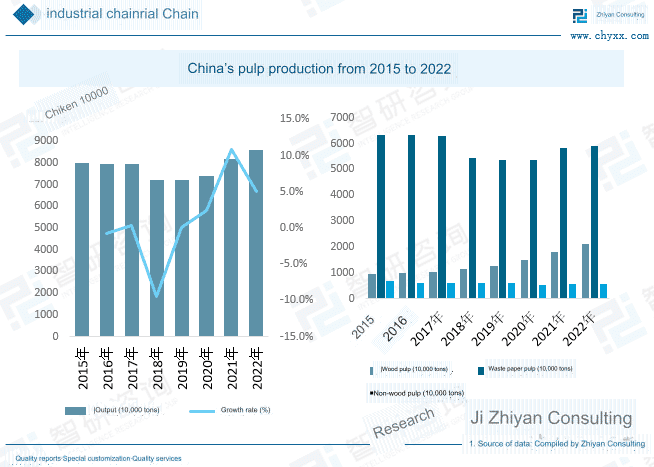

Pulp is the main raw material in the production of household paper, accounting for about 50%-70% of the production cost. In 2022, China’s pulp production reached 85.87 million tons, a year-on-year increase of 5.01%. Of this, wood pulp production was 21.15 million tons, up 16.92% year-on-year; recycled paper pulp production was 59.14 million tons, up 1.72% year-on-year; and non-wood pulp production was 5.58 million tons, up 0.72% year-on-year.

Related report: “Analysis of China’s Household Paper Industry Development Model and Future Prospect Planning Report” released by Zhiyan Consulting

IV. Analysis of China’s Household Paper Industry Development Status

Household paper is a necessary fast-moving consumer good in daily life, and its consumption is generally not affected by economic conditions. During economic strength, consumption growth is faster, but during economic weakness, people who have developed the habit of using these products mostly won’t choose to stop using them. Some may switch to more economical products, which affects market sales to some extent but has limited impact on consumption volume, mainly affecting away-from-home (AFH) or commercial products. The consumption level of household paper is considered one of the indicators of a country’s modernization and civilization level.

Over the past 30 years, with China’s rapid economic growth, improved living standards, and changing consumer habits, the demand for household paper products has been continuously increasing. Product categories have become more comprehensive, product functions have further differentiated, and the scale of household paper manufacturers has continued to expand, making China one of the most notable emerging markets globally. In 2022, China’s household paper industry continued to grow, with total industry capacity reaching 20 million tons, the highest level in history. Production reached 11.35 million tons, a year-on-year increase of 2.7%, while consumption reached 10.59 million tons, a year-on-year increase of 1.24%.

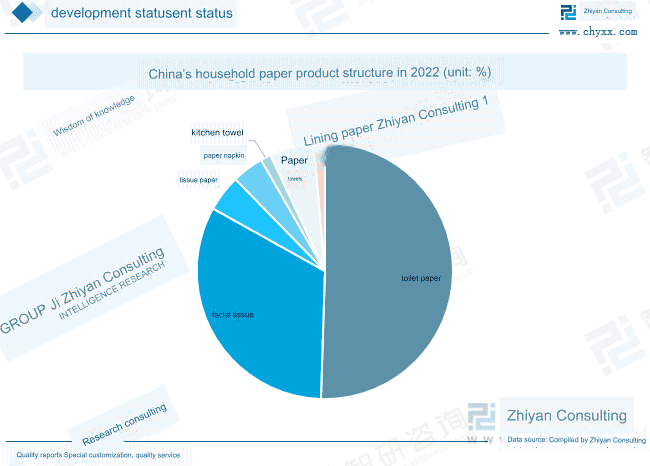

In 2022, among the types of household paper products in China, toilet paper remained the largest category by consumption, accounting for 50.6% of the total. It was the most produced and consumed paper type, followed by facial tissues, hand towels, handkerchiefs, napkins, liner papers, and kitchen paper towels. The overall product structure tends to be stable, with the proportion of toilet paper products in the industry slightly declining, while the proportions of more specialized product categories are gradually increasing. Additionally, the consumption of wet toilet paper products is gradually rising, which to some extent substitutes traditional toilet paper products, contributing to the decline in the proportion of toilet paper products.

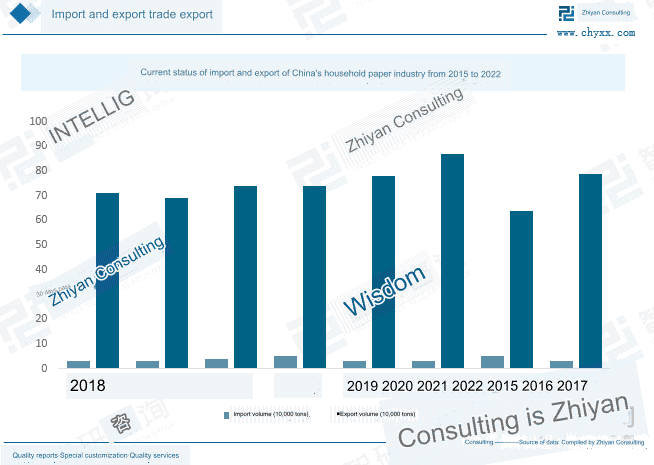

China’s household paper product exports are an important part of the consumer market, accounting for about 6.24% of production in 2022. In 2022, both the export volume and value of China’s household paper products increased significantly year-on-year. Export volume reached 785,700 tons, a year-on-year increase of 22.89%, while export value reached $2.034 billion, a year-on-year increase of 38.6%. Among these, the export volume of base paper grew the most, with a year-on-year increase of 65.21%. However, finished paper products still dominated exports, accounting for 76.15% of the total export volume of household paper products. Both the volume and price of finished paper exports increased, with the average export prices of toilet paper, handkerchiefs, and facial tissues all increasing by over 20%. The increase in the average price of exported finished paper products was a key factor driving the overall growth in export value of household paper products in 2022. Among the export destinations for China’s household paper products in 2022, the top three countries and regions by export volume were Australia, Hong Kong, and Japan.

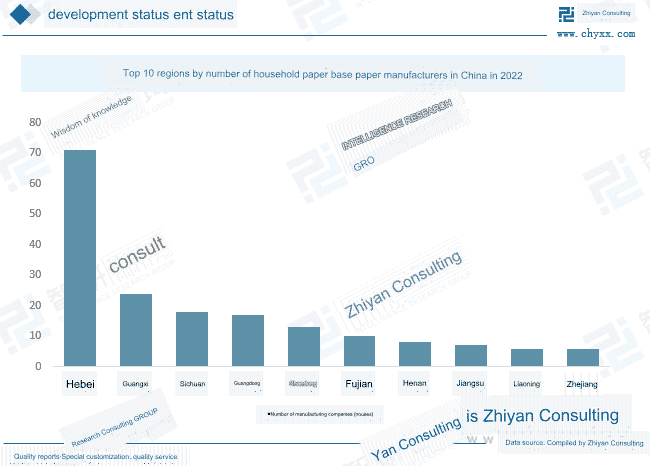

In 2022, there were 213 companies producing base paper. Ranked by the province where the group is located, Hebei Province had the most base paper production enterprises at 71, followed by Guangxi, Sichuan, Guangdong, and other provinces. The total number of enterprises was less than in 2021 (241), as backward production capacity continued to be eliminated, resulting in a significant decrease in the number of base paper production enterprises. Additionally, due to high raw material prices throughout the year and intense market competition, some enterprises using modern production capacity were also in a state of suspension, and the industry entered an accelerated reshuffling stage.

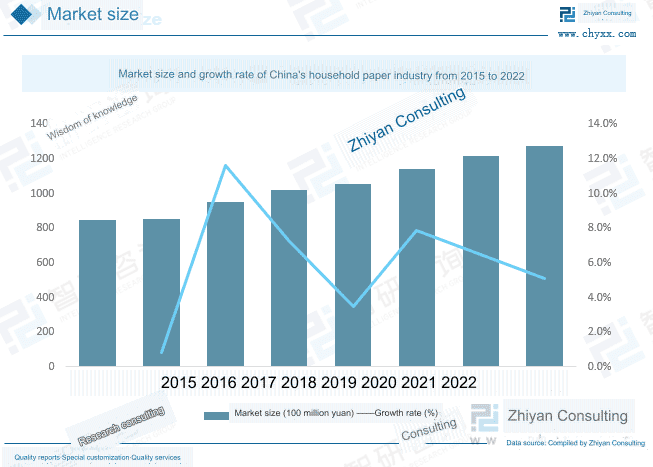

In recent years, the market size of China’s household paper industry has continued to grow. In 2015, the market size was 84.59 billion yuan, and by 2022, it had grown to 127.62 billion yuan, with a CAGR of 6.05% from 2015 to 2022.

V. Analysis of China’s Household Paper Industry Competitive Landscape

The paper industry is a technology-intensive and asset-heavy industry. Entering the household paper sector is often restricted by equipment investment, technical support, capital requirements, local policies, and other factors, so the overall industry entry barrier is not low. The paper industry has strong geographical characteristics, with product distribution generally limited to local and surrounding areas. In recent years, riding the “tailwind” of internet and information technology industry development, many local brands and small and medium-sized enterprises have achieved rapid development by deploying e-commerce systems and online channels. Compared to physical operations, the difficulty and cost of developing online businesses are relatively low. Due to the convenience of online shopping, many emerging brands have gained popularity among consumers through online advantages, such as TANGO, Kechu, Duyuanyuan, Jinqijian, CANARY, and others that have attracted younger generations. Therefore, in the long term, the branding and quality improvement of household paper products remain clear consumption trends in the industry.

| Major household paper companies in China | |

| Company Name | Business Overview |

| Zhongshun Jierou Paper Co., Ltd. | Zhongshun Jie Rou Company currently owns three main brands: Jie Rou, Tai Yang, and Duo Lei Mi; its products include toilet paper rolls, coreless toilet paper rolls, tissue paper, paper handkerchiefs, wet wipes, personal care products such as baby diapers, and cotton wipes. |

| Vinda International HoldingsLimited Company | Vinda Group has established 10 advanced production bases in mainland China and one production base in Taiwan, China.Malaysia has two major production bases, Vinda V inda, Tempo, Tork, Tim TENA, Dr.P, Libresse, Libero, Drypers and other major brands have developed production Multiple industries including tissue, incontinence care, feminine care, baby care and home hygiene solutionsService. |

| Hengan International Group Co., Ltd. | It is currently the largest manufacturer of household paper and maternal and child hygiene products in China. Hengan owns four well-known Chinese trademarks, namely Anerle, Xinxiangyin, Seventh Generation, and Anerle. Its three leading products, sanitary napkins, diapers, and household paper, rank among the top in domestic market share. |

| Zhejiang Jingxing Paper Industry Co., Ltd.company | Jingxing Paper is a professional manufacturer of packaging paperboard and household paper. The company’s main papermaking enterprise The products include kraft linerboard, white kraft paper, high-strength corrugated base paper, tube paper, household paper, cartons The professional development and scale-up process make the company a leader in the development of packaging paperboard in China.production base and one of the advanced manufacturing bases in Zhejiang Province. |

| Shandong Sun Paper Co., Ltd. | The company now has the world’s leading pulping and papermaking production lines, and its products have gradually formed a six-series product structure dominated by high-end coated packaging paperboard, high-end art coated paper, high-end cultural office paper, special fiber dissolving pulp, household paper, and high-end industrial packaging paper. |

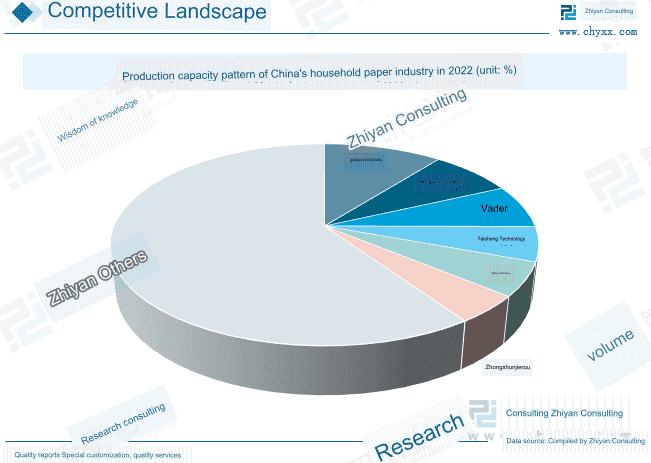

The continuous improvement in equipment levels in China’s household paper industry has also raised the starting point for latecomers, leading to overall industry competition trends of high-end technology and product homogenization. In this context, we believe that competition solely based on cost control and price-performance improvement is increasingly difficult to bring significantly above-industry returns. Differentiated competition centered on product branding is the key to achieving premium pricing. Currently, China’s four leading household paper enterprises have achieved their respective successes in brand building, realizing market share leadership and product premiums. The competitive landscape of the household paper industry shows prominent polarization characteristics. Under the overall intense competition, homogeneous competition among leading enterprises is tending to ease. Looking at the production capacity distribution of China’s household paper manufacturers, the top five in terms of capacity in 2022 were APP China (Gold Hongye), Hengan International, Vinda, Lee & Man, and C&S Paper, with their combined capacity accounting for 40.46% of the total.

VI. Outlook for China’s Household Paper Industry

With the continuous maturation of production technology and equipment, the industry faces prominent homogenization issues. Enterprises should enhance their market marketing capabilities, especially in sales channel construction; strengthen brand cultivation; focus on new product development, particularly functional design; and develop differentiated products with new production and equipment technologies. At the same time, enterprises should strengthen internal management, implement refined production and operation management; additionally, through the application of new technologies and equipment, reduce energy and material consumption per unit of product to lower production costs, promote high-quality development of enterprises, and enhance the market competitiveness of products.