Potential Impact of the Russia-Ukraine Situation on China’s Pulp and Paper Industry

Since the onset of the Russia-Ukraine conflict, global economic development across various regions has been affected to varying degrees. For the pulp and paper industry, China’s raw materials, whether wood pulp or wood chips, largely depend on international markets. Finished paper products, especially high-end ones, also require some level of importation. Therefore, in the face of complex international conditions, such as rising commodity prices, exchange rate fluctuations, disruptions in international logistics, and supply chain risks, stakeholders across the forestry industry’s value chain should closely monitor the development of the Russia-Ukraine situation. They should promptly adjust their development strategies, formulate responsive policies, avoid potential risks and losses for enterprises, and seek opportunities for business growth.

The Russia-Ukraine conflict has lasted for over three months. The ensuing disputes and economic sanctions have caused large-scale disruptions to Ukraine’s economic activities and plunged Russia’s economic development into a state of difficulty. The instability has also affected industrial production and trade flows worldwide, leading to increased volatility in global stock markets, foreign exchange markets, and futures markets. Sanctions imposed on Russia by some Western countries have caused a significant rise in the prices of energy resources such as crude oil and natural gas, as well as other raw materials, pushing up the costs of industrial production and logistics. Specifically in the pulp and paper industry, we can observe frequent price hike notices from various European paper production companies. In 2021, Russia’s export value of forestry products exceeded $12 billion, with imports around $2 billion. The economic sanctions imposed on Russia and the disruption of logistics due to the conflict will undoubtedly affect the global trade flow of forestry products, posing potential business risks and losses for trade partners. In recent years, China’s trade relations with Russia have continued to expand, and as one of Russia’s major trading partners, China is expected to experience a certain degree of impact. This article provides an objective overview of the pulp and paper industry in Russia and Ukraine, analyzes the potential impact of the conflict on China’s pulp and paper industry based on the current flow of forestry product trade, and offers corresponding suggestions for short-term responses by domestic paper and board companies.

Dynamics of Russian and Ukrainian Pulp and Paper Enterprises

Since the conflict began, Eduard Litvak, Executive Director of the Ukrainian Pulp and Paper Industry Association, announced that all pulp and paper companies in Ukraine have ceased production. Military actions across the country have led to the collapse of logistics and supply chains, and regional factories will temporarily close for the safety of employees.

Most Russian pulp and paper companies have maintained normal production; however, leading European pulp and paper companies such as Mondi and Stora Enso have announced the suspension of their production and operations in Russia. Smurfit Kappa has announced its withdrawal from the Russian market, and chemical supplier Kemira has suspended supplies to Russia and Belarus. Due to a shortage of chemicals, Russia’s Arkhangelsk Pulp and Paper Mill has adjusted its products, shifting to unbleached pulp and kraft paper production. Some ongoing projects have been postponed due to funding issues. The series of sanctions resulting from the war have affected the normal production and operations of Russian pulp and paper companies to some extent. These companies have begun adjusting their strategies and supply chains, developing new products, and seeking new target markets.

Overview of the Russian and Ukrainian Forestry and Pulp and Paper Industries

Russia has abundant forest resources, accounting for more than one-fifth of the world’s forest area. About one-third of these forests are old-growth forests, 64% are naturally regenerated forests, and 2.4% are plantation forests. Russia’s timber resources account for about one-quarter of the global total, primarily including coniferous species such as larch, Scotch pine, white pine, and red pine. Russia’s main timber exports are larch, followed by Scotch pine and spruce. Russia’s pulp production capacity accounts for about 4% of the global capacity, approximately 10 million tons, with two-thirds used for producing factory-supported paper and board and one-third as market pulp mainly for export. Russia’s total paper and board production capacity is about 12 million tons, including 3 million tons of cultural paper, 850,000 tons of tissue paper, and nearly 8.5 million tons of packaging and specialty paper. Russia’s leading pulp and paper producers include Ilim Group, Mondi, Pulp Mill Holding, JSC Solikamsk, and JSC Kondopoga, with a combined capacity of 11.5 million tons, accounting for 52% of Russia’s total capacity. Additionally, Russia is further expanding its pulp and paper capacity, with announced paper and board projects planning a total capacity of 4.8 million tons, including 4 million tons of containerboard, 300,000 tons of tissue paper, and about 460,000 tons of other paper types. Announced pulp projects have a planned capacity totaling about 480,000 tons.

In terms of trade, Russia is a net exporter of paper and board, with exports mainly focused on kraftliner, newsprint, sack paper, and offset paper. China is one of its main export destinations for kraftliner and newsprint. Russia also imports about 800,000 to 900,000 tons of paper and board, primarily coated board and coated paper, mainly sourced from Finland, Germany, Poland, and Sweden, with about 50,000 tons of coated board imported from China. In pulp, Russia is a major global supplier of market pulp but also imports a small amount. In 2021, total imports amounted to 270,000 tons, with a significant portion being fluff pulp. The United States is its largest trade partner, accounting for 28%, followed by Finland (24%), Belarus (21%), and Sweden (12%). The interruption of imports may impact Russia’s production of sanitary products.

Ukraine’s paper and board market is relatively small, with a total capacity of about 1.2 million tons, mainly focusing on containerboard, with about 800,000 tons, and tissue paper capacity of 220,000 tons. Ukraine relies partially on imports for its paper and board needs, as well as for fiber raw materials such as wood pulp and recycled paper. In terms of trade partners for paper and board, major partners include Finland, Germany, Poland, Russia, Austria, Sweden, and China, which together account for 64% of its total imports. For pulp, Russia is Ukraine’s main supplier, followed by Belarus, Sweden, the United States, and Finland. Exports to Ukraine from these countries, due to factory shutdowns, will likely be suspended, at least in the short term.

China and Russia’s Trade Flows

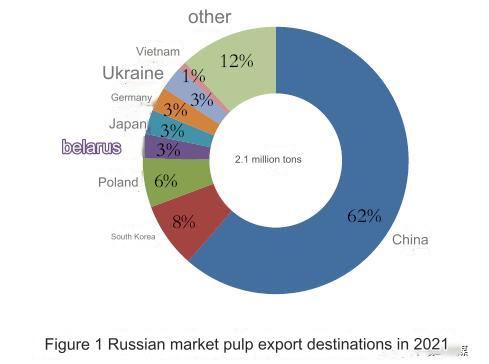

Looking at the global trade of pulp, Russia’s export volume of commercial pulp has maintained at 2.1-2.3 million tons in recent years, accounting for 4-5% of the global trade volume. In 2021, exports were 2.1 million tons, a 9% decrease from 2020. China is its largest trading partner for commercial pulp, accounting for up to 62%, with about 400,000 tons exported to Europe, mainly to neighboring countries such as Poland, Belarus, Germany, and Ukraine, as shown in Figure 1. Of this, BSKP exports were about 1.2 million tons, with about 81% exported to the Chinese market; UKP exports were nearly 500,000 tons, with about 47% exported to China, followed by South Korea (10%) and Germany (8%). Currently, all paper enterprises in Ukraine have stopped production, while Russia has not seen widespread production stoppages. However, due to sanctions on related chemical companies, some pulp and paper mills have had to partially convert their products. At present, wood pulp has not been included in the list of sanctioned products prohibited from trade, but if the war continues, this possibility cannot be ruled out. In that case, countries such as Japan, South Korea, and Germany will have to turn to other major suppliers of commercial pulp, especially for softwood pulp, needing to turn to countries like Canada, the United States, and Chile. At the same time, to maintain production, Russia will have to increase exports to certain trading partners and seek new export destinations.

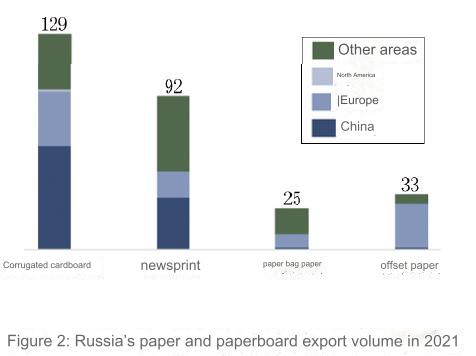

In terms of paper and paperboard, Russia’s exports are concentrated in containerboard (1.29 million tons), newsprint (920,000 tons), coated paper (330,000 tons), and sack paper (250,000 tons), with export destinations shown in Figure 2. China is the main destination for Russia’s containerboard and newsprint exports, with some exports also going to the European market. If sanctions escalate, some paper and paperboard exports may be temporarily halted, and exports to China will also be under pressure due to logistical obstacles. Some European countries have already experienced shortages of printing paper due to supply disruptions.

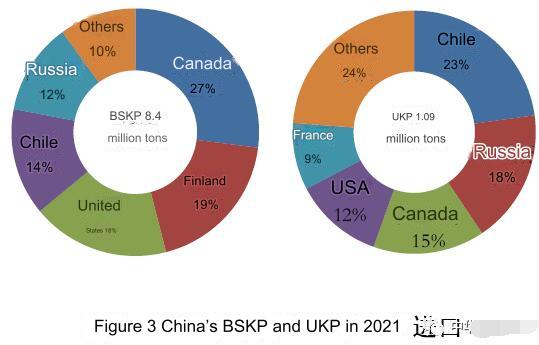

From China’s domestic perspective, the demand for wood pulp largely depends on imports. In 2021, China’s pulp imports were about 23.7 million tons, of which 6% (1.3 million tons) came from Russia. Specifically, for unbleached pulp, Russia is China’s second-largest supplier. Due to China’s waste paper import ban, there has been a shortage of domestic fiber resources, and imports of unbleached pulp have grown significantly in recent years. In 2021, unbleached pulp from Russia reached about 200,000 tons, 50,000 tons less than the largest supplier, Chile. For bleached softwood pulp (BSKP), Russia also plays an important role in supplying China. In 2021, China imported 8.4 million tons of BSKP, of which 1 million tons came from Russia, as shown in Figure 3. Ilim’s NBSKP is one of the main delivery grades on the Shanghai Futures Exchange. Since the conflict began, domestic BSK futures and spot prices have started to rise, with the domestic pulp index (sp8888) breaking through the 7000 mark and maintaining high volatility.

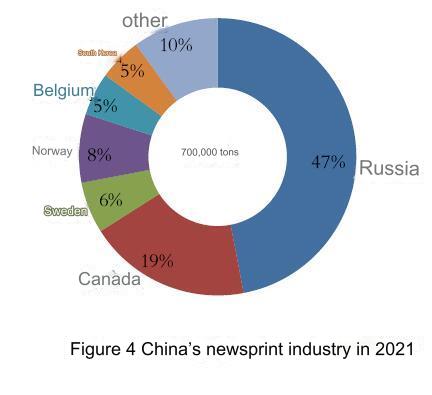

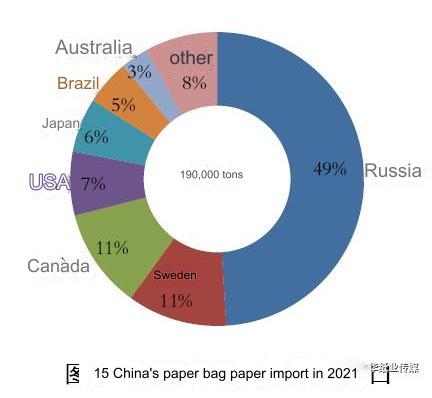

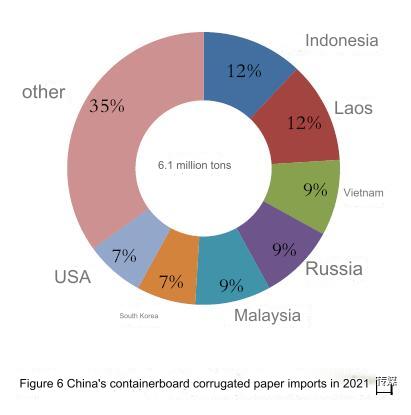

In terms of paper and paperboard, Russia is also one of the main source countries for China’s newsprint, sack paper, and containerboard, as shown in Figures 4, 5, and 6. Particularly for newsprint and sack paper, imports from Russia accounted for nearly 50% of China’s total imports in 2021, and China’s domestic dependence on imports for these two paper types is relatively high. This shows that Russia plays an important role in supplying newsprint and sack paper to China. For containerboard, China imported 6.1 million tons in 2021, with Russia accounting for 9% of total imports, about 550,000 tons, including 190,000 tons of all-wood pulp kraftliner. Russia is the second-largest source of kraftliner for China, after the largest source, the United States (400,000 tons of kraftliner).

Looking at the upstream of the pulp industry chain – logs and wood chips, Russia is the world’s largest timber exporter, with log exports of 14 million m³ in 2021. It is also one of the main sources of pulpwood and wood chips globally, mainly exporting to neighboring Finland (>90%). Russian exports account for 77% of Finland’s total imports, and benefiting from land transportation, importing pulpwood and wood chips from Russia has certain cost advantages. Russia’s other export destinations include Sweden and Germany. The Russian Far East is a major source of softwood chips for China and Japan, with total exports of about 800,000 bone dry tons. China’s dependence on overseas markets for pulp wood chips is high, with leading pulp mills importing 40-80% of their required wood chips. In the past five years, China’s average wood chip imports have been around 13 million bone dry tons. In 2021, total imports were 15.6 million tons, a significant increase from 2020, mainly from Vietnam (57%), Australia (18%), and South American countries like Chile (6%) and Brazil (4%). Russia exports a small amount of softwood chips to China. From these data, it can be seen that direct trade in wood chips has a relatively small impact on China’s pulp and paper market, but it will undoubtedly be indirectly affected by the reorganization of global wood chip trade flows. Affected by the Russia-Ukraine conflict, Russia has already banned the export of logs, wood chips, sawn timber, and other forest products to EU countries, the United States, Canada, Japan, South Korea, Taiwan, New Zealand, Australia, Norway, the United Kingdom, and other regions. More countries and regions may be added to the restricted export list. In this sense, Russia may increase exports to Asia and other regions, while the EU, especially countries with large imports of Russian forest products, will need to find other import sources in a timely manner to meet normal production needs.

Regarding logs, Russia has imposed restrictions on the export of softwood logs and high-value hardwood logs since January 1, 2022, by increasing export tariffs. It is expected to formally ban their export from 2023, which will also affect timber trade flows to some extent. In recent years, Russia’s log exports have decreased, but the volume of processed wood products and other forest products has gradually increased. In 2021, China imported a total of 67.76 million m³ of logs and 28.84 million m³ of sawn timber. Russia is the largest source of sawn timber for China, accounting for 55%, followed by Thailand, Canada, and the United States. In 2021, Russia’s log exports to China totaled 6.9 million m³, accounting for about 11% of China’s total imports, ranking after New Zealand (31%) and Uruguay (16%). In addition to directly imported wood chips, residues from imported logs and sawn timber processing are also a source of raw materials for domestic pulp mills. Therefore, the trade flow of logs and sawn timber will also affect the availability of domestic pulp raw materials to some extent.

Ukraine banned the export of hardwood logs in 2015 and softwood logs in 2017. Its sawn timber exports account for a small proportion of the international market, and the overall impact on timber market supply is expected to be small. In terms of pulp wood chips, its export destinations are mainly Turkey and Romania, with a volume of only about 100,000 tons, which has little impact on international wood chip trade flows.

Potential Impact on China’s Pulp and Paper Industry and Response Measures for Domestic Enterprises

Russia is rich in energy resources and serves as a primary source of natural gas and oil for the European Union (EU). In 2021, Europe’s natural gas consumption was approximately 480 billion cubic meters, with about 90% of it being imported. Around 40% of the EU’s imported natural gas and 27% of its imported oil came from Russia. Following the outbreak of the conflict, coupled with sanctions, Europe has faced a natural gas shortage, causing energy prices to surge, which in turn has driven up the manufacturing costs of various industrial products, including forestry products. According to the ban issued by Russia’s Ministry of Industry and Trade, Russia has prohibited the export of certain forestry products (including wood chips, logs, and veneer sheets) to countries/regions on its sanctions list. This will undoubtedly reduce Europe’s cost advantage in commodity pulp and paper and hinder its product exports, to some extent benefiting North and South American pulp and paper companies. Additionally, the Program for the Endorsement of Forest Certification (PEFC), which oversees the largest certified forest area globally, has labeled timber from Russia and Belarus as “conflict timber,” meaning it can no longer be used in PEFC-certified products. Another major forest certification body, the Forest Stewardship Council (FSC), which has the largest number of certified holders globally, has also made a corresponding decision after careful consideration to temporarily suspend transactions involving FSC-certified materials and controlled wood from Russia and Belarus until the conflict ends. This means that as long as the conflict persists, timber and forestry products from Russia and Belarus will be excluded from the two most popular forest certification systems globally. This will affect the international trade flow of forestry products and companies’ choices of raw materials to some extent.

To date, some countries/regions and companies/organizations have initiated trade and financial sanctions against Russia, and the scope and intensity of these sanctions may increase further. Russia has also implemented reciprocal sanctions against multiple countries/regions. The uncertainty of the Russia-Ukraine conflict, along with possible future sanctions from more countries and regions, puts global economic growth under pressure, further increasing energy and inflationary pressures, disrupting global supply chain trade, and impacting countries and regions with frequent trade relations with Russia, including China. This situation has increased the instability of the business operations of Chinese domestic timber and pulp traders, challenging the continuity, timeliness, and pricing of supplies to some extent. Although the overall volume of coated paper, whiteboard paper, and offset paper products exported from the EU and other regions to Russia is not large, these products will need to find new export destinations, which will likely shift to demand-resilient Asian regions such as China, depending largely on cost competitiveness. On the other hand, for those types of paper that Russia needs to import in small quantities, China may consider increasing its exports; some paper companies are reportedly already exploring this business.

From the perspective of enterprises, the uncertainty of the conflict has affected the production and operations of some Russian pulp and paper companies. The deteriorating environment may disrupt foreign companies’ investment intentions in Russia, leading to the temporary suspension of many previously planned investment projects in Russian forestry products. This also affects the plans of domestic companies attempting to improve their supply chains by investing in Russian forest land, with some ongoing and planned projects in Russia being delayed due to funding issues. This could lead to future global forestry product supply shortages, posing dual pressures on China in terms of wood chip and pulp supply shortages and rising prices.

From the market perspective, the pulp and paper industry is energy-intensive, with energy costs accounting for approximately 10% to 15% of the cost of different types of paper. For an industry already operating on thin margins, rising energy costs will put pressure on pulp and paper companies, as well as downstream printing and packaging companies. Combined with the rising prices of other cost factors, this may reduce the competitiveness of fiber-based products in the overall packaging industry, accelerate the penetration of electronic and digital alternatives in the cultural paper sector, and hinder the healthy growth of domestic paper and board demand.

In the face of these uncertainties, domestic pulp and paper companies must first ensure the stability of raw material supplies to maintain sustainable production. Companies that rely on imported raw materials should diversify their supplier management while using futures tools for pulp to control costs and expand domestic raw material procurement to mitigate the risks associated with unstable overseas supplies. Considering the expansion of domestic pulp production capacity, companies should also timely adjust their wood chip procurement strategies and closely monitor the development of the Russia-Ukraine conflict and related sanctions to make appropriate responses. Second, to ensure profitability amidst rising raw material prices, production companies need to implement lean management practices to improve quality and efficiency. This can be achieved by adjusting pulp ratios, reasonably arranging equipment maintenance, managing spare parts, raw material and finished product inventories, and utilizing information management to reduce production and management costs. Third, for product sales, leading companies should not only stabilize and expand domestic sales but also actively seek overseas export opportunities, aiming to secure a position in the reshaped trade flows of international markets. China’s paper and board exports amount to 6 to 7 million tons, primarily sold to neighboring Asian countries and regions. In the future, companies could explore export opportunities for coated paper and board that Russia needs to import, as well as the possibility of expanding exports to European regions. Export businesses should continuously monitor whether trade countries and regions impose sanctions on Russian products, such as prohibiting the use of Russian-produced pulp raw materials, and consider collaborating with reliable domestic and international traders/distributors, leveraging their trade and customer networks to achieve short-term export growth. In the process of developing overseas markets, companies should also take precautions against risks related to logistics, payments, and exchange rates.

Since the onset of the Russia-Ukraine conflict, global economic development across various regions has been affected to varying degrees. For the pulp and paper industry, China’s raw materials, whether wood pulp or wood chips, largely depend on international markets, and finished paper products, especially high-end ones, also require some level of importation. Therefore, in the face of complex international conditions, such as rising commodity prices, exchange rate fluctuations, disruptions in international logistics, and supply chain risks, stakeholders across the forestry industry’s value chain should closely monitor the development of the Russia-Ukraine situation. They should promptly adjust their development strategies, formulate responsive policies, avoid potential risks and losses for enterprises, and seek opportunities for business growth.