JD’s 2024 Paper Products Industry Consumer Trends Report: Specialized Products Gaining Attention

Overview of the Paper Products Market

Facial tissues, toilet paper, pocket tissues, lotion-infused tissues, wet wipes, dry cleaning wipes… Which paper products do you regularly use in your daily life? As essential household items, paper products have evolved into a massive industry worth billions of dollars as consumers increasingly demand higher quality products. The market now features specialized functions, innovative effects, and purpose-specific paper products.

JD’s Consumer and Industry Development Research Institute recently released the “2024 Paper Products Industry Consumer Trends Report” (hereafter referred to as “the report”), which analyzes current consumption patterns and predicts future trends to help businesses better understand consumer needs and promote sustainable, high-quality industry development. The report indicates that as consumers’ purchasing power increases, they increasingly prefer “specialized paper for specialized uses,” demonstrated through segmentation by usage scenario, demographic preferences, and product functionality.

In the cleaning paper category, dry cleaning wipes, lotion-infused tissues, facial tissues, and pocket tissues have shown impressive sales growth. In feminine care products, sanitary pad sets, period underwear, and mini sanitary pads have achieved significant growth. In the diaper category, swim diapers for infants and toddlers are growing rapidly, while adult and baby pull-up diapers are also outperforming market averages.

Consumer Demographics and Regional Differences

From a demographic perspective, women are the “core decision-makers” for paper product purchases. Geographically, Guangdong and Jiangsu provinces have the highest concentration of “bulk buyers,” while Xinjiang and Hainan lead in per capita spending. Different regions show distinct preferences for product categories: consumers in Gansu, Heilongjiang, and Jilin provinces spend more on cleaning paper products; Shanghai, Tianjin, and Tibet show higher spending on feminine care products; and Guangdong, Guangxi, and Hainan consumers allocate more of their budget to diaper products.

Cleaning Paper Products: Brand Loyalty and Consumer Preferences

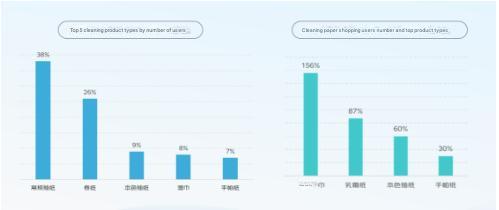

JD Supermarket sales trends show that in the cleaning paper category, regular facial tissues, toilet paper, unbleached facial tissues, wet wipes, and pocket tissues rank in the top five for user numbers. Dry cleaning wipes and lotion-infused tissues have seen the largest growth in users, at 156% and 87% respectively. Regarding product features, consumers are most interested in water resistance, tear resistance, absence of fluorescent brighteners, and soft texture. Additionally, disposable face wipes, antibacterial properties, hanging-style tissue boxes, 100% cotton materials, and eco-friendly adhesive-free options are gaining consumer attention.

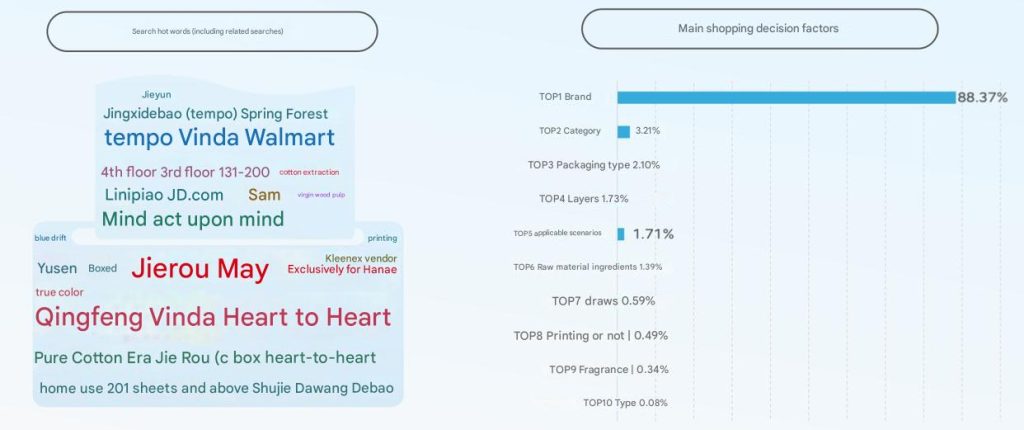

For facial tissues, many consumers search directly by brand name when selecting products, indicating that brand is a significant factor in the decision-making process. Other important considerations include packaging format, number of plies, intended use scenario, and material composition. Long-term repeat purchasers pay more attention to material quality, appearance, user experience, and effectiveness. Consumers of premium-priced tissues are more sensitive to product fragrance, while those buying lower-priced options focus more on product specifications and dimensions.

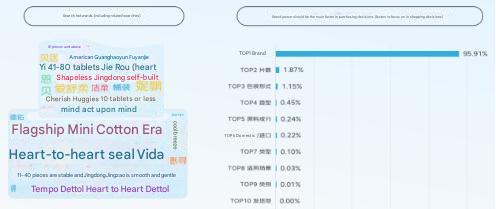

When purchasing wet wipes, consumers similarly prioritize brand, with 95.91% of consumers considering this their primary criterion, followed by sheet count, packaging format, and fragrance. Repeat customers pay more attention to product appearance/color, materials, and effectiveness, with attractive design, compact packaging, and premium appearance all receiving positive consumer feedback. Higher-priced wet wipe purchasers focus more on user experience, while budget-conscious consumers prioritize specifications and dimensions.

Feminine Care Products: Innovation and Health Consciousness

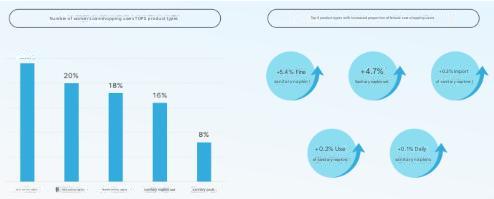

Feminine care products represent another important category in the paper products industry. JD Supermarket sales data shows that regular sanitary pads, period underwear, overnight pads, sanitary pad sets, and panty liners receive the most consumer attention. In 2023, period underwear, sanitary pad sets, mini sanitary pads, overnight pads, and regular sanitary pads saw the highest growth in user share. Regarding product features, consumers are most interested in breathability, moisture control, and quick absorption, while antibacterial properties, 100% cotton materials, multiple size options, and ease of changing are gaining attention with considerable growth potential.

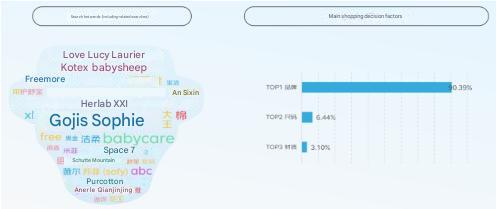

Period underwear is a high-interest category within feminine care products, with 90.39% of consumers prioritizing brand when shopping, followed by size and material. Repeat purchasers pay more attention to user experience, appearance/color, and product effectiveness. Both premium and budget-conscious repeat customers are particularly sensitive to the overall user experience.

In recent years, female consumers have become increasingly health-conscious, with heightened attention to menstrual wellness. The report shows that 48% of female consumers prioritize products that “absorb well and keep skin clean without stickiness,” while “thin, breathable, and unnoticeable” and “quick absorption” are also core features that attract female consumers. Since feminine care products are high-frequency, high-repurchase necessities, users prefer comprehensive e-commerce platforms that offer better promotional discounts, fast logistics, and guaranteed authentic products.

Baby Diapers and Adult Care Products: Comfort and Performance

In the diaper and adult care product category, baby pull-up pants, baby diapers, and adult care pads receive the most consumer attention. Baby pull-up pants, adult pull-up pants, baby swim diapers, adult care pads, and adult diapers have shown the fastest growth in user share.

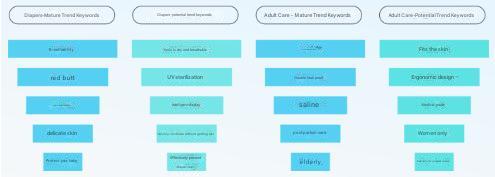

JD Supermarket sales trends indicate that consumers purchasing baby products are most concerned with breathability, safety, and comfort. “Cloud-soft dryness,” UV sterilization, and “smart wetness indicators” are technological features attracting increasing consumer interest. Consumers of adult care products focus more on materials and leak protection, with products that conform to the body, incorporate ergonomic design, and meet medical-grade hygiene standards showing greater sales growth potential.

When selecting baby pull-up pants, brand is the primary factor, influencing nearly 60% of the target audience, followed by size, packaging format, and domestic/imported status. Repeat purchasers pay more attention to user experience, materials, and appearance/color. Regarding specific aspects of user experience, usability, breathability, and comfort are most likely to earn consumer approval. Regardless of whether they purchase premium or budget baby pull-up pants, consumers are particularly sensitive to specifications and sizing.

In the adult diaper category, brand influence is even more pronounced, with 86.61% of consumers considering this factor. Repeat purchasers focus more on user experience, product effectiveness, and materials, with good absorption capacity and strong absorbency being particularly appealing to consumers.

Future Market Trends

The report concludes that as high-frequency consumer goods, paper products are becoming increasingly diversified and specialized in their application scenarios, with a clear trend toward “specialized paper for specialized uses.” For baby paper products, development and marketing should focus on the needs of millennial parents; the cleaning paper market should target Gen Z consumers; and the adult care market needs to emphasize product adaptability for different demographics, enhancing ergonomic design to improve user comfort.

Additionally, consumers across all three major paper product categories share similar priorities: brand is the main pre-purchase consideration, while repeat purchases are more influenced by user experience and actual product performance. Companies need to focus on material quality to increase consumer loyalty.