In-Depth Report on the Paper Industry: The Evolution of Household Paper in China and the U.S.

Growth Potential in China’s Household Paper Industry

The household paper industry in China is still in a growth phase, with room for improvement in both volume and price. In 2010, the per capita consumption of household paper was just 3.6 kg, rising to 5.7 kg by 2016, with an average annual increase of 0.3 kg. However, this lags significantly behind developed countries (e.g., 24.9 kg in North America and 15.6 kg in Japan in 2015). Conservative estimates predict that between 2017 and 2026, per capita consumption in China will grow by an average of 0.25 kg annually, reaching an estimated 8.2 kg by 2026. In 2018, the per capita expenditure in the U.S. was $42,800, while in China it was only 25,300 RMB. From 2010 to 2018, the compound annual growth rate (CAGR) for per capita consumption was 3.3% in the U.S. and 11.6% in China, with the latter expected to remain above 10% in the long term, reflecting ongoing improvement in consumption levels. Additionally, the consumption structure of household paper in China still has room for adjustment, and consumption upgrades are expected to drive multi-category and multi-dimensional demand expansion, indicating vast potential for industry growth and continued medium to high-speed development.

Market Dynamics and Competition

Compared to the mature household paper market in the U.S., China’s market concentration is still in the early stages, characterized by intense competition. The current CR4 (market share of the top four companies) in China’s household paper industry is only 30%, significantly lower than the 75% in the U.S., indicating substantial room for growth. Leading companies have yet to establish a clear competitive advantage, meaning the market structure remains fluid. As consumer preferences evolve, regional small paper mills will face increasing pressures from larger companies, including financial constraints for upgrading equipment, brand enhancement challenges, and channel expansion difficulties. Additionally, new regulations such as pollution permits and environmental taxes, coupled with persistently high wood pulp prices, will continue to squeeze profit margins for small and medium enterprises. Therefore, the trend toward increased market concentration is likely to continue, benefiting leading firms and enabling them to capture greater market share. Furthermore, with expected future increases in wood pulp prices, controlling upstream raw material resources may mitigate the impact of cost fluctuations on leading companies, and expanding upstream operations could create synergistic effects, ultimately leading to an oligopoly structure similar to that of mature markets.

Success Factors for Leading Companies

The success factors for leading companies in the industry include product innovation, omni-channel development, nationwide capacity layout, and horizontal category expansion.

- Product Innovation: Upgrading product quality and packaging increases added value.

- Omni-Channel Development: In today’s fragmented information environment, relying on a single channel is insufficient for market share growth. Leading companies are reforming their approaches across multiple channels—dealer, direct, e-commerce, and retail—to enhance market share.

- Nationwide Capacity Layout: High transportation costs for household paper drive companies to minimize the distance between production bases and sales networks. A nationwide capacity layout has become essential for development as leading firms expand their marketing networks.

- Horizontal Category Expansion: Expanding into personal care products has become a significant trend for leading household paper companies, improving profit margins while cultivating new growth opportunities.

| Why learn from the United States? | The current stage of China’s household paper industry | |||

| There are many similarities between China and the United States in the early stages of industrial development of household paper. | Product homogeneity is serious, the industry is fragmented and competition is fierce, production capacity is in periodic excess, and there is huge room for improvement in concentration. | |||

| With speed and rich development experience, borrowing stones from other mountains and supplementing them with national conditions, we have achieved remarkable results. | The bargaining power for raw materials is at a disadvantage globally, and the Matthew effect of the leading position is significant. | |||

| The industry’s growth prospects are optimistic, the industry is accelerating integration, clearing out backward production capacity, and transforming to high-quality diversified development | ||||

| The development history of household paper in the United States | The stage of China’s household paper industry in 2019 | |||

| prosperous period | Industry consolidation period | Mature and stable period | slow decline | |

| (before 1970) | (1970-2000) | (2001-2010) | (2011 to present) | |

| The continuously growing wealth of U.S. residents has effectively promoted the release of consumption potential. | Industry production capacity is growing rapidly, demand continues to increase, and personal care product innovation and development have strong momentum. | The industry’s production capacity tends to be stable, revenue grows steadily, and concentration reaches a high level | The industry has entered the late stage of maturity and its development has fallen into a downturn | |

| The economic leap brought about by the “Gilded Age” and the “Baby Boom” has led to the continuous expansion of the U.S. tissue paper industry, and the business has shown a trend of diversified expansion. | Environmental protection laws strictly regulate and rectify the industry, and outdated production capacity is eliminated | Comprehensive improvement of product structure and categories, and comprehensive upgrade of product quality | Strong bargaining power in the industry | |

| The merger wave at the end of the 20th century eliminated some small and medium-sized enterprises, and the industry concentration further increased | Demographic changes bring challenges but also new opportunities | |||

Source: Huaxi Securities

Conclusion:

The outlook for China’s household paper industry is optimistic, with significant growth potential and ongoing industry consolidation. While challenges such as competition and rising raw material costs persist, leading companies are well-positioned to leverage strategic innovation and market expansion. The industry is likely to continue evolving towards higher quality and diversified offerings, ultimately resembling a more mature market structure akin to that of the United States..

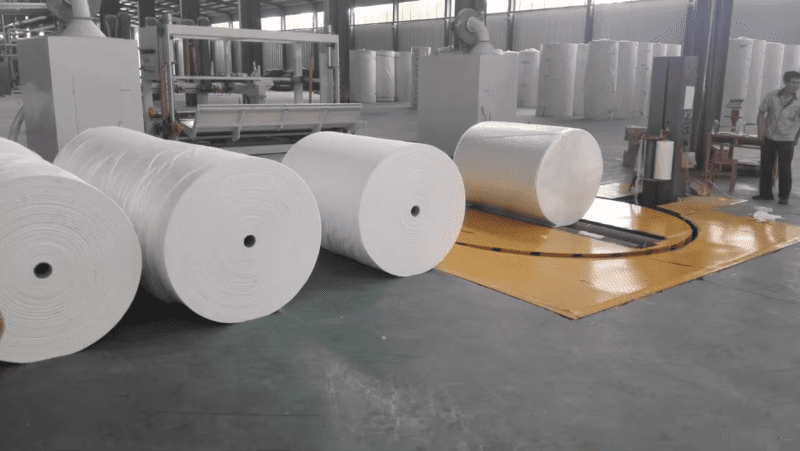

YuanhuaPaper are a tissue paper mill with over 20 years in China. We supply tissue Mother/parent rolls for Toilet tissue, Facial tissue, hand towel paper, Kitchen towel and Napkins, etc. Welcome any detailed requirements like usage, size, ply, weight, etc. Waiting for your INQUIRY.